Last updated:

Here are real-time business electricity rates for Texas:

| Provider | Contract Length | Rate |

|---|---|---|

| NRG | 6 months | 6.02 ¢/kWh |

| Gexa Energy | 6 months | 6.24 ¢/kWh |

| Hudson Energy | 6 months | 6.50 ¢/kWh |

| Pulse Power | 18 months | 6.57 ¢/kWh |

| Direct Energy | 6 months | 6.57 ¢/kWh |

| AP GAS & ELECTRIC (TX) LLC | 6 months | 6.59 ¢/kWh |

| Pulse Power | 30 months | 6.75 ¢/kWh |

| NRG | 18 months | 6.78 ¢/kWh |

| Pulse Power | 12 months | 6.78 ¢/kWh |

| Freepoint Energy Solutions | 6 months | 6.78 ¢/kWh |

| Pulse Power | 36 months | 6.82 ¢/kWh |

| Pulse Power | 24 months | 6.82 ¢/kWh |

| NRG | 30 months | 6.89 ¢/kWh |

| NRG | 12 months | 6.92 ¢/kWh |

| NRG | 60 months | 6.95 ¢/kWh |

| NRG | 24 months | 6.95 ¢/kWh |

| NRG | 36 months | 6.97 ¢/kWh |

| NRG | 48 months | 6.98 ¢/kWh |

| AP GAS & ELECTRIC (TX) LLC | 18 months | 7.00 ¢/kWh |

| IronHorse Power Services | 6 months | 7.06 ¢/kWh |

| Hudson Energy | 18 months | 7.10 ¢/kWh |

| AP GAS & ELECTRIC (TX) LLC | 12 months | 7.12 ¢/kWh |

| Gexa Energy | 18 months | 7.18 ¢/kWh |

Data source: Direct from commercial energy providers and our own internal, proprietary data source, collection, and/or analysis.

Commercial Energy Providers

These are some of the larger commercial electricity providers in Texas. This list is not exhaustive and does not constitute an endorsement or recommendation of any particular business electric company.

| 4Change Energy | Amigo Energy |

| APG&E | Atlantex Power |

| Champion Energy Services | Chariot Energy |

| Cirro Energy | Constellation |

| Direct Energy | Discount Power |

| ENGIE Resources | Energy Texas |

| Flagship Power | Frontier Utilities |

| Gexa Energy | Green Mountain Energy |

| Just Energy | Payless Power |

| Pulse Power | Reliant Energy |

| Rhythm Energy | SFE Energy Texas |

| Shell Energy | STAT Energy |

| TriEagle Energy | TXU Energy |

| Veteran Energy |

Types of Commercial Plans

While fixed-rate energy plans are the most popular choice for businesses in Texas (and other deregulated states), businesses have a few different options:

-

Fixed-Rate Plans: Businesses secure a consistent rate per kilowatt-hour (kWh) for the contract duration, typically 12 to 60+ months. Popular for its predictability, this plan shields companies from market price volatility, ensuring stable budgeting.

-

Block and Index Plans: Designed for larger enterprises, this plan locks in a fixed price for a predetermined “block” of energy usage. Excess consumption is priced at the fluctuating market (index) rate, balancing cost certainty with potential savings during low market prices.

-

Variable-Rate Plans: Rates adjust monthly based on wholesale market changes. While this may yield savings during low-demand periods, businesses face significant risks from price surges, such as during extreme weather events like Texas summer heatwaves.

- Time-of-Use Plans: Rates vary between peak and off-peak hours, rewarding businesses that shift high-energy tasks (e.g., manufacturing or electric vehicle charging) to nights or weekends with lower costs, optimizing savings for flexible operations.

Texas Commercial Electricity

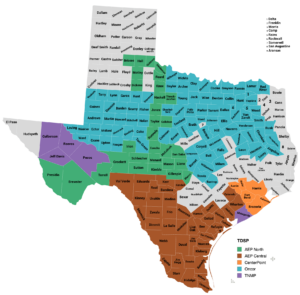

Texas operates one of the largest deregulated electricity markets in the United States where businesses in certain areas can choose their Retail Electricity Provider (REP). Roughly 85% of the state’s population resides in a deregulated area equating to roughly 26 million people.

- Deregulated Market: Approximately 2.52 million businesses in Texas, or 85% of total businesses in Texas, operate in deregulated areas, allowing them to shop for electricity rates

- Competitive Pricing: Texas business electricity rates typically range from 8 to 12 cents per kWh. Lower rates are available with custom pricing and for larger commercial & industrial businesses.

- Deregulated Cities/Areas: Major business centers like Houston (CenterPoint Energy), Dallas-Fort Worth (Oncor), and Corpus Christi (AEP Texas) help make up 85% of the deregulated electricity market.

- Regulated Cities/Areas About 15% of businesses, located in areas like Austin (Austin Energy), San Antonio (CPS Energy), and El Paso, are served by regulated utilities without REP options.

- Market Oversight: The Public Utility Commission of Texas (PUCT) regulates the deregulated market and helps educate and protect businesses

FAQ

Most of Texas has a deregulated electricity market. This means that instead of being forced to buy power from a single local utility, businesses can shop among competing Retail Electric Providers (REPs) for better rates, different plan structures, and better service.

Your utility, or Transmission and Distribution Utility (TDU), is responsible for the physical infrastructure (poles, wires) that delivers electricity to your business. Major TDUs in Texas include CenterPoint, Oncor, and AEP Texas. Your Retail Electric Provider (REP) is the company you buy the electricity from; they handle billing, customer service, and set your rate.

Unlike residential service, the best commercial rates are not “one-size-fits-all.” To get the lowest rate, you need a custom quote based on your business’s specific usage patterns. Submitting your usage history to multiple providers allows them to compete for your business, driving down your price.

To get an accurate custom quote, you’ll typically need 12 months of your business’s electricity usage history from past bills. This data includes your monthly kWh consumption, peak demand, and load factor, which providers use to calculate your custom rate.

A fixed-rate plan is the most common choice for businesses. It locks in your energy charge rate (¢/kWh) for the entire length of your contract (e.g., 12, 24, 36 months). This provides budget certainty and protects your business from volatile price swings in the energy market.

A block and index plan is a hybrid strategy for larger businesses. You lock in a fixed price for a “block” of your expected power usage, and any electricity used beyond that block is purchased at the variable wholesale market (index) price. It offers a balance of stability and potential savings but carries more risk than a fully fixed plan.

Demand charges are based on your peak demand—the highest amount of electricity your business consumes at any single point during a billing cycle, measured in kilowatts (kW). Your utility (TDU) charges this fee to ensure the grid can meet your business’s maximum power needs.

Load factor is a percentage that measures how consistent your energy use is. A high load factor (steady, consistent usage) is more predictable and attractive to providers, often resulting in a lower per-kWh rate. Businesses with sporadic, high-peak usage (a low load factor) may see higher rates.

Yes. Beyond the energy rate, your bill includes TDU delivery charges, taxes, and potentially other provider fees. Always review the Electricity Facts Label (EFL) for any plan you consider. This document provides a transparent breakdown of all charges.

Commercial contracts are typically longer than residential ones. Common term lengths range from 12 months to 60 months (5 years). Longer contracts can often secure a lower rate, but offer less flexibility if your business needs change.

An ETF is a penalty charged if you break your contract before its end date. Unlike residential ETFs, which are often a flat fee, commercial ETFs are typically calculated based on the remaining term of the contract and market conditions, and can be very substantial. It’s crucial to understand the ETF terms before signing.

Your provider will notify you before your contract ends. If you take no action, they will typically move your account to a variable “holdover” or “rollover” rate, which is almost always significantly higher than your fixed contract rate. It’s critical to shop for a new plan before your current one expires.

The process is simple. Once you’ve chosen a new provider and plan, you sign a new contract. The new provider handles the entire switch with your utility (TDU). There is no need for a site visit or new equipment.

No. The switch is purely administrative and seamless. Your TDU (e.g., CenterPoint, Oncor) continues to deliver power without interruption. The only change you will see is a new bill from your new provider.

Your ESI ID (Electric Service Identifier) is a unique 17- or 22-digit number for your service location. It’s the most important piece of information for getting an accurate quote. You can find it on any of your previous electricity bills.

For power outages, downed power lines, or other infrastructure emergencies, you must call your local TDU (CenterPoint, Oncor, AEP, etc.), not your retail provider. The TDU is responsible for maintaining the grid’s safety and reliability.

Yes. Texas is a leader in renewable energy, especially wind power. Many providers offer competitive commercial plans sourced from 100% renewable energy, allowing your business to meet sustainability goals, often with little to no price increase.

Possibly. In Texas, businesses that are predominantly engaged in manufacturing, processing, or fabrication may qualify for a sales tax exemption on their electricity bills. You must submit a Predominant Use Study and an exemption certificate to qualify.

The best times to lock in a new rate are during the “shoulder months” of spring (March-May) and fall (September-November). During these mild-weather periods, energy demand is lower, leading to more competitive wholesale prices and lower contract rates.

Commercial plans differ in several ways: rates are based on custom quotes, contracts are longer, bills include demand charges, and early termination fees are much higher. The entire pricing structure is designed around a business’s unique, high-volume consumption profile.