Last updated:

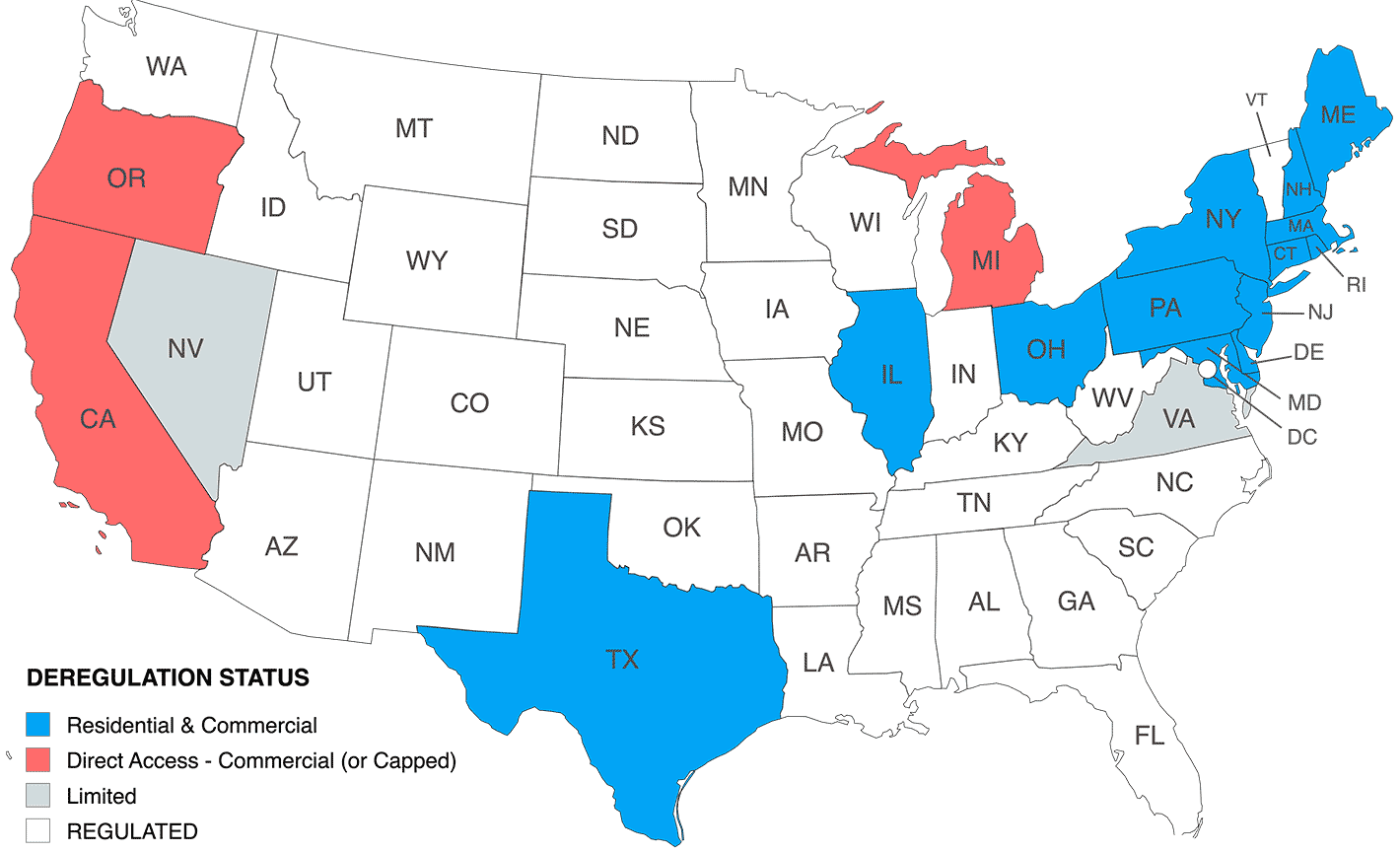

This is a one-of-a-kind collection of data on the status of electricity deregulation in the United States.

Estimates are used where official statewide counts aren’t published. Residential choice is 0% where no residential retail choice exists. “Limited / Capped” indicates constrained C&I programs.

Customer Eligibility: Classes allowed to choose a supplier.

Switching Rate: Share of eligible customers who switched.

Switched Customers: Estimated customers served by competitive suppliers.

Market Notes: Year & key rules shaping the market.

Texas

Residential

Commercial & Industrial

Ohio

Residential

Commercial & Industrial

Illinois

Residential

Commercial & Industrial

Pennsylvania

Residential

Commercial & Industrial

New Hampshire

Residential

Commercial & Industrial

Rhode Island

Residential

Commercial & Industrial

Connecticut

Residential

Commercial & Industrial

Maryland

Residential

Commercial & Industrial

Massachusetts

Residential

Commercial & Industrial

New Jersey

Residential

Commercial & Industrial

New York

Residential

Commercial & Industrial

Maine

Residential

Commercial & Industrial

Delaware

Residential

Commercial & Industrial

Michigan

Residential

Commercial & Industrial

Oregon

Residential

Commercial & Industrial

Virginia

Residential

Commercial & Industrial

California

Residential

Commercial & Industrial

Nevada

Residential

Commercial & Industrial

Data sources: Hundreds of individual sources including utility filings, regulatory proceedings, public utility commission reports, ISO/RTO materials, market monitor summaries, and national energy data collections.